Monday, December 5, 2011

What are defaults to the EU?

My EU view: Defaults happen all the time. Banks fail all the time. Defaults don't destroy currencies, they just destroy the value of debt issued in that currency. Defaults don't destroy wealth, since they are just the accountant's way of recognizing economic realities. The value of global financial assets fluctuates by trillions of dollars every day and yet economic life goes on. There is a virtually unlimited supply of capital in the world ready to fund profitable new ventures and/or to recapitalize failed banks. Truth be told, the market has already wiped out almost 80% of the market cap of Eurozone financial institutions in the past four years, yet the Eurozone economies continue to function as always...the only reason that no one is talking about a simple, proven, market-based approach to solving the Eurozone sovereign debt problem is that politicians fear that highly indebted countries are more likely to default (i.e., to act irresponsibly) than they are to cut spending, and that this, in turn, puts Eurozone banks (who hold tons of Eurozone sovereign debt) at risk, and that this, in turn, puts the very viability of the Euro and the Eurozone economies at risk. Politicians love to think this way, because it makes them indispensable. The truth, however, is that when politicians step into the fray to fix things, they almost always make the situation worse.

Saturday, November 19, 2011

Panic exhaustion... has already happened

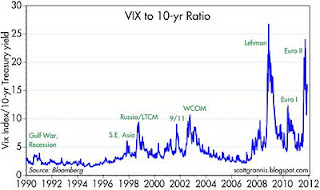

To judge by the Vix/10-yr ratio, markets and investors have only been so consumed by fear, uncertainty, doubt, and pessimism once before—the period starting with the collapse of Lehman in 2008 and ending with the beginning of the current recovery in mid-2008. But back then we did have monster defaults and we saw the decimation of banks and their balance sheets, and we did have a global economic collapse and a financial panic that brought us very close to the feared abyss called "the end of the world as we know it." Today we have been waiting 18 months for this to happen again

markets are very, if not extremely, pessimistic, and valuations are therefore very attractive

Circling back to the bond market, the level of 10-yr Treasury yields is extremely low, and is consistent with the view that the outlook for the economy is utterly dismal.

I'm not sure I have a good explanation for these disconnects. Spreads in the U.S. are priced to a modest level of concern, while spreads in Europe are priced to an extremely high level of concern. Treasury yields and PE ratios, in contrast, are priced to the gloomiest of outlooks. But however you look at it, there appears to be no shortage of pessimism in today's market pricing. In fact, optimism is very difficult, if not impossible, to find. AAPL, for example, has a forward-looking PE ratio of only 10.9 according to Bloomberg, which means the market is extremely skeptical of analyst's earnings projections. AAPL's current PE of 13.6 is only slightly higher than the S&P 500's 12.8, and this for a company that has grown earnings at a spectacular rate for years.

I'm not sure I have a good explanation for these disconnects. Spreads in the U.S. are priced to a modest level of concern, while spreads in Europe are priced to an extremely high level of concern. Treasury yields and PE ratios, in contrast, are priced to the gloomiest of outlooks. But however you look at it, there appears to be no shortage of pessimism in today's market pricing. In fact, optimism is very difficult, if not impossible, to find. AAPL, for example, has a forward-looking PE ratio of only 10.9 according to Bloomberg, which means the market is extremely skeptical of analyst's earnings projections. AAPL's current PE of 13.6 is only slightly higher than the S&P 500's 12.8, and this for a company that has grown earnings at a spectacular rate for years.

Wednesday, November 16, 2011

Retail Sales Show Sturdiness

October retail sales exceeded expectations (+0.5% vs. +0.3%), and this is one more sign that the economic slowdown which troubled financial markets in late summer is now a thing of the past. Retail sales have advanced 7.2% over the past year and continue to post new highs, despite the fact that there are 6.5 million fewer people working today than there were at the early-2008 high in employment. The U.S. economy has proved far more dynamic and resilient than expectations, and that is an important factor driving equity prices higher even as the world frets over the possible consequences of Eurozone sovereign debt defaults. U.S. economic growth can trump all sorts of ills.

Monday, November 14, 2011

US Trade Reality

Friday, November 11, 2011

Nov 11 2011 - Economic Blog

CB Pundit said it best: Markets in general are doing their best to send a message to countries with bloated governments: if you don't clean up your act, we are going to punish you. Markets can usually get their way, so I wouldn't be anxious to bet on an end-of-the-world-as-we-know-it scenario.. I don't think we'll see an actual default, but when markets get like this then they can easily draw blood. Italy is going to have to do something meaningful to staunch the bleeding.

CB Pundit said it best: Markets in general are doing their best to send a message to countries with bloated governments: if you don't clean up your act, we are going to punish you. Markets can usually get their way, so I wouldn't be anxious to bet on an end-of-the-world-as-we-know-it scenario.. I don't think we'll see an actual default, but when markets get like this then they can easily draw blood. Italy is going to have to do something meaningful to staunch the bleeding.

Monday, March 5, 2007

Subscribe to:

Posts (Atom)